I would say that most dentists and physicians are rich, but very few are wealthy. What’s the difference?

The rich are not financially free because they are dependent on their jobs. The rich trade time for money, and if they ever stop working for whatever reason, they could face financial disaster as their funds are depleted to maintain their lifestyles.

The difference between the rich and the wealthy is that the wealthy never have to worry about losing their jobs because they have income independent of their jobs.

What’s the difference between rich and wealthy dentists? The way in which they spend their money For the rich, all incoming money is spent to cover living expenses, debts, other financial obligations, and the acquisition of nonproductive assets. What are nonproductive assets? Assets that not only cost money to acquire but to upkeep as well. Think of cars, toys, and even the family residence as examples of nonproductive assets.

The wealthy spend their money differently than the rich. They have living expenses as well, but they minimize their debt and minimize acquiring nonproductive assets. Instead, they allocate savings to acquiring productive assets; investments generate income instead of taking it away.

So what kind of assets do the wealthy gravitate towards to generate passive income? There are two assets that the wealthy prefer over all others for their portfolios.

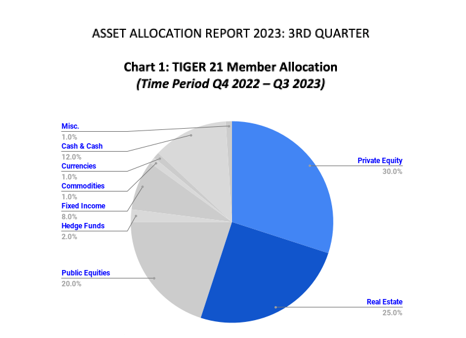

The chart below will clue you in on what these assets are.

The chart above is the latest asset allocation report of TIGER 21, an exclusive peer-to-peer investing club of ultra-high-net-worth individuals consisting of successful entrepreneurs, professionals, and executives. Prospective members are required to show $50 million in investable assets to join. Each quarter, the members of TIGER 21 publish an asset allocation report showing where they placed their money for that quarter.

According to this latest report, the members of TIGER 21 allocated 55% of their assets to two assets in particular: real estate and private equity (investment in the ownership of private companies). The investing habits of the members of TIGER 21 are consistent with the investing habits of the ultra-wealthy in general, who consistently allocate more than half of their portfolios to these two assets.

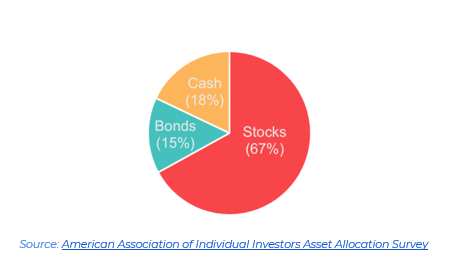

In my last article, I mentioned that the wealthy invest differently from the average investor. Check out the asset allocations of the average investor.

The average investor allocates heavily towards stocks. Whether because of tradition, social conditioning, family habits, or workplace norms, the average American gravitates heavily towards stocks and bonds. It’s what Wall Street wants, and it’s how they thrive. It’s why Wall Street dominates the media—to maintain its iron grip on the investing public. In addition, Wall Street will also sow seeds of fear about alternative investment strategies to scare investors away from trying something other than Wall Street.

One of the talking points that Wall Street constantly overemphasizes is the riskiness of alternative investments like real estate and private equity. Those assets are too risky. That’s why you should stick to a diversified stock portfolio, they tell you. The wealthy don’t drink the Wall Street Kool-Aid. They know better, and what they know is that private alternative investments like commercial real estate and income-producing private businesses can not only generate above-market returns but do so at less risk. They would allocate more than 50% of their portfolios to these assets if that weren’t true. They’re too smart to stick with losing investments, and real estate and private equity are not losers but winners.

Dentists and physicians may be high earners and consider themselves rich, but unless they change their money habits and acquire assets that can generate income and add to their wealth instead of taking it away, they will always be slaves to their jobs. They will always be trading time for money. Until they can generate passive income and start buying back their time, they will never be financially independent, able to walk away from their jobs if they choose, and able to breathe easy during downturns while everyone else panics.

It’s no secret that dentists and physicians experience some of the highest levels of stress and job dissatisfaction of any group of professionals. From my own observations, it’s because of financial stress and the inability to break the chains of dependency on their jobs to meet their financial obligations.

The few dentists and physicians who live stress-free are the ones who find an alternative path to writing the next chapter in their lives. They discover the world of alternative investments like real estate and private equity capable of generating passive income. And multiple streams of passive income that have the ability to replace any lost income from job loss give professionals not only peace of mind but also the flexibility to set their own schedules, knowing they can take days off because they have other sources of income.

Are you working to pay the bills, or are you working towards financial independence?

Unless you have passive income, you’ll always be doing the former. To achieve the latter, consider alternatives to Wall Street.